Butler National Corporation (BUKS) FY24 and Q4 Earnings

The story is coming together with a great quarter with record earnings

Butler National released their Q4 earnings yesterday evening and as we expected, there are big improvements YoY in most metrics.

Here is a link to the press release: https://butlernational.com/fy-2024-q4/

Current Price: $0.90 USD

My cost: $0.76 USD

Market Cap: $61.78M

For a refresher and to summarize my previous posts, here are the improvements BUKS has made over the last 3 to 4 years which I think should drive a higher earnings multiple than the company has historically traded at:

Purchased the land and building of the casino in 2020 (no more lease payments and have been paying down their debt at a good clip).

~2021 they purchased 100% of the economics/earnings of the casino, prior to that they only collected 60% of the earnings and 40% went to a minority partner.

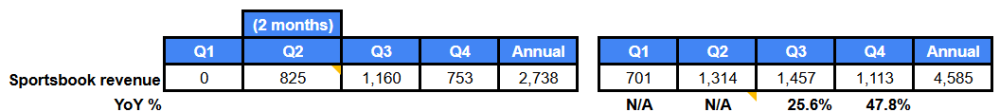

in FY23Q2, they added a (1) turn-key online sportsbook with DraftKings (BUKS earns commission on Draft Kings' KC customers), as well as (2) an in-person DraftKings branded sportsbook to their casino. Revenues appear to be growing nicely, although still too early to draw any conclusions:

Removed the CEO, his son, and a son-in-law (architect) from the payroll who were earning higher than market salaries, saving roughly $1M+ in operating costs annually. The COO, Christopher Reedy, has now taken over the CEO role without a huge pay increase.

Repurchased $5M stock (on a ~$60M market cap company) - mostly from the outgoing CEO and son.

Completely new insider — Joseph Daly (founder/CEO of Essig Research which has been around over 30 years and provides high-tech engineering and manufacturing services. One of his areas of expertise is aviation / aerospace) — has bought ~12% of the company in the open market, sits on the board, and is now the largest shareholder.

Completed construction of a new hangar in 2023, and purchased KC machine (asset and skilled labour purchase - almost no goodwill), to expand capacity and address their record backlog.

Just completed their move to a larger HQ and sold their last HQ.

With today's results BUKS is trading around a 7 EV/E, although that includes some gains on sales of airplanes and a building. If we look at EBITDA excluding the gains they trade at a 4.4 EV/EBITDA, but this doesn't exclude maintenance CapEx. Neither metric is perfect, but the company looks cheap to me and both those multiples include a mediocre Q1 in Trailing Twelve Months (TTM) results. The company also has considerable book value of ($40M+).

Note: Q1 appears to typically be their worst quarter, but I'm hoping for YoY improvement when they report in September based on the reasons above.

Additional Notes

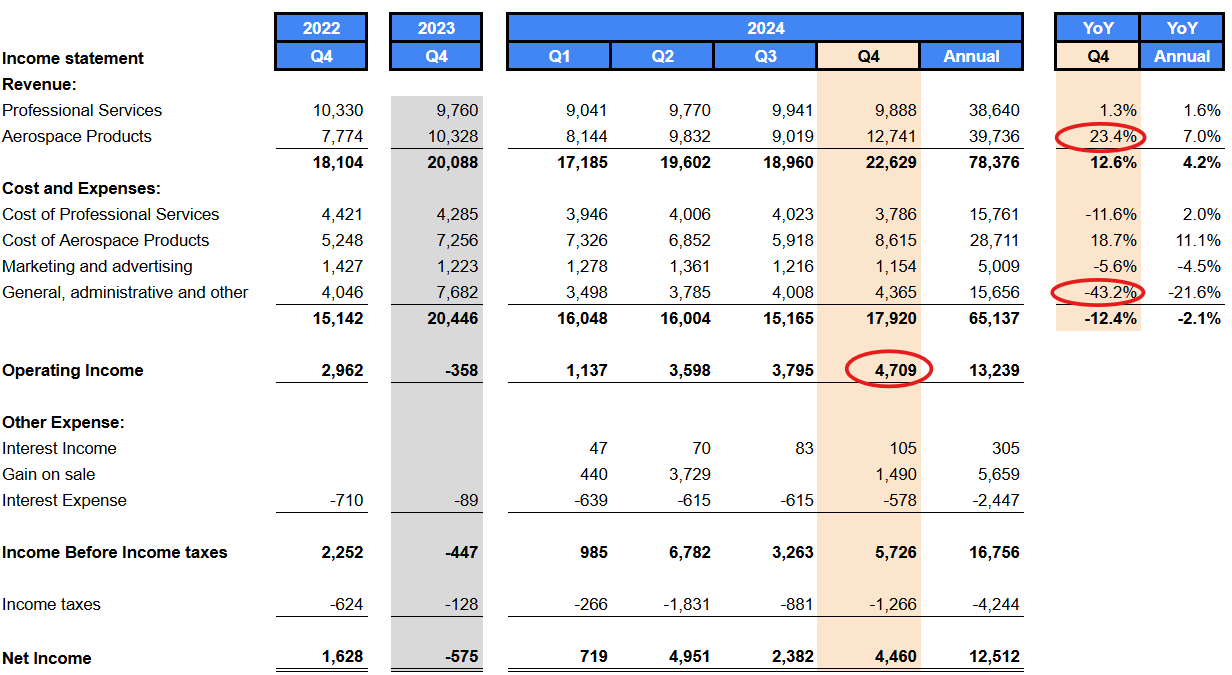

Since they don't break out Q4 in the earnings report here are the amounts:

Very good: (1) increase in aerospace revenue; (2) increase in operating income; and (3) decrease in G&A.

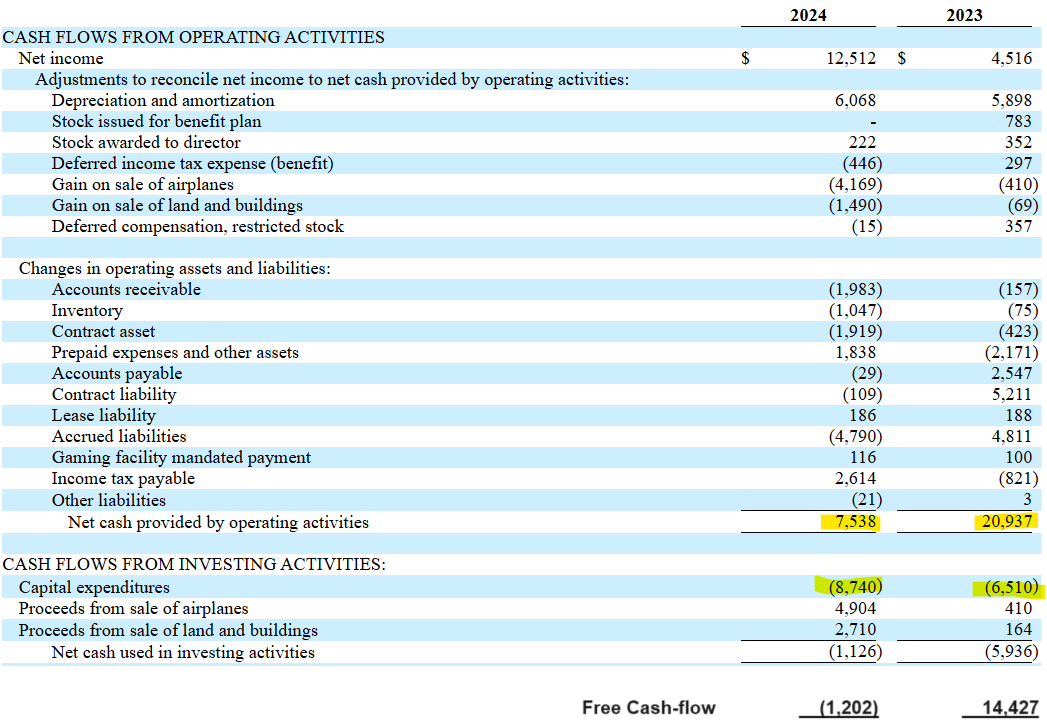

On the other hand free cash-flow (FCF) doesn't look as great this year:

My thoughts on FCF:

There were significant swings in current assets and liabilities which inflated cash-flow in 2023 and swung back in 2024 i.e. accrued liabilities changes were the largest and contributed to a $9.6M difference.

They purchase airplanes and re-sell them for a profit, I am thinking this helps them use up capacity and recently has earned them nice gains/profits. However, since these are recorded as capital assets and other income, the gains are removed from operating cash-flow, but the airplane purchases are kept in Capital expenditures (either both should be removed or included if we consider it part of their normal business).

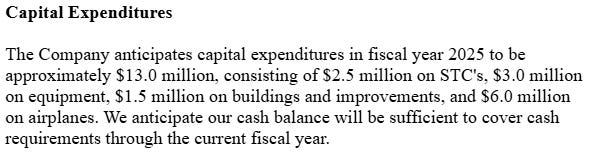

They have been spending significantly on capital projects (CapEx) and there isn't an exact breakdown of the CapEx spend for 2024 that I could find, but see excerpt below for 2025 where they expect to spend $13M on CapEx:

I think the only thing we should be deducting from FCF is maintenance CapEx since growth CapEx is intended to drive revenue growth, but it is hard to differentiate between growth and maintenance for BUKS.

$6.0M of airplanes I would argue should be more like inventory and not CapEx, but as long as they continue to sell for a profit I think we can conclude that airplanes are growth CapEx.

$2.5M of STC's are the approvals they get for new modifications on airplanes which they can market/sell to customers. I think this would be growth, but to-date we haven't seen huge increases in revenue resulting from these new STC approvals. I am hoping we see more significant revenue growth in aerospace now that capacity has been added.

The $3.0M equipment and $1.5M on buildings and improvements is likely primarily maintenance CapEx and should be deducted from FCF. Regarding building improvements, as part of a contract with a government to run a casino you are required to invest a certain $ amount in improvements over the life of the contract.

Where do we go from here?

We'll see how the market reacts to the results today, but short-term moves often don’t mean much anyway. I expect (and hope) Butler National will continue to perform and the market will start to recognize the company as under-priced. One way to unlock further shareholder value, in the future, would be if we saw a sale of the casino so they can focus on the growing Aerospace business. Typically the market doesn’t like two unrelated businesses under the same umbrella and the casino, while being a cash-cow, isn’t growing much outside of the Sportsbook.

Thank you for reading, here is a link to my full public portfolio in Google Sheets: Curious Investing Portfolio

Disclaimer: As of July 24, 2024, I am a shareholder of Butler National Corporation at an average cost base of $0.76. My plan at the time of writing is to hold these shares long-term, but I may have sold my position by the time you’re reading this. This is not a purchase recommendation and I can only hope that I’m right on 3 out of 5 (60%) investments I make — this could be one I’m wrong on. Please do your own research and double-check my data & findings. Please also read my disclaimer and process here: Curious Investing Disclaimer and Process

Very good analysis. Good detail on planes purchases recorded as Capex instead of inventory. Thanks for the article