See the link below for a story about when I gave stock picks to my father-in-law:

I recently came across an article by Josh Tarasoff titled “Conviction and Quality,” and I wanted to share some of its key ideas with you. You can explore Josh’s work here:

https://www.greenlealane.com/public

Rather than dissecting the entire article, I will summarize some ideas and thoughts the article brought up for me.

Implicit and Explicit Information/Conviction

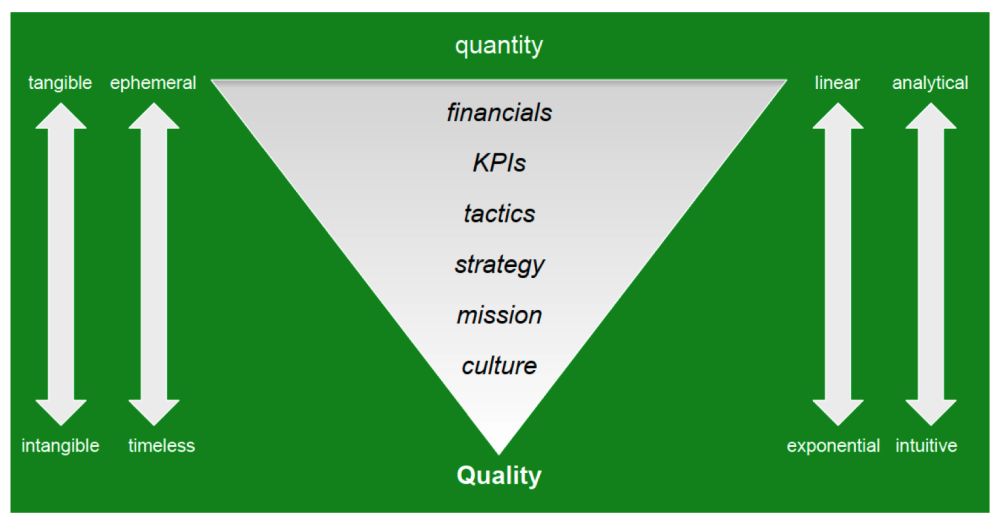

The core of Josh’s article revolves around two types of information that we base our conviction on: implicit and explicit.

Explicit conviction, as I call it, comes from having figured something out. It entails a useful prediction, like “our ETA is 5pm” or “majoring in economics will lead to better career prospects than majoring in philosophy.” There is an underlying logic to it, which can be explained and used to persuade. Implicit conviction, on the other hand, is exemplified by the trust one might have in a family member, a dear friend, a close colleague, to do the right thing, to get the job done, to come through. It is felt as opposed to believed.

- Josh Tarasoff

So explicit information includes tangible, measurable factors, such as:

Analysing a company’s financial statements, valuation, and growth; and,

Information that may disqualify a company right when you see it → red flags like poor capital allocation, low insider ownership, high debt, over-reliance on a single customer or vendor, and legal issues.

I believe explicit analysis is table stakes at this point and every investor must do this well to succeed.

Implicit information, on the other hand, relies on gut feelings and intuition, covering areas like:

Management and governance;

Culture;

Business Model; and,

Industry and Market, including competition and total addressable market (TAM)

Implicit analysis is harder to teach & convey and, as a result, I think this is where good investors can develop a sustainable edge.

The lists above are not exhaustive, but these are some of the main factors many investors, myself included, consider before investing in any business.

My Takeaways and Learnings

With these concepts in mind, here are my primary takeaways from Josh’s article, particularly related to the “Quality” section:

Many companies pass my explicit filter (solid fundamentals and minimal red flags) and many companies pass my implicit filter (intuition of quality), but few will pass through both filters. This is because cheap companies tend to have worse quality and high quality businesses tend to be expensive.

I have companies in my portfolio that pass my explicit filter only (cheap), but the vast majority have both aspects. It is harder to know when the market will agree with you for a company that is just cheap -- especially if you're a smaller investor with limited avenues for promotion. However, quality companies grow revenue and earnings, which the market is more likely to eventually recognize.

One of my favourite parts of the article was this:

“Well-honed intuition does what analysis cannot by perceiving Quality directly, as opposed to through an intellectual process. What I suspect is happening in the direct perception of Quality is subconscious pattern recognition, based upon a dynamic, holistic experience of the thing in question.”

Implicit conviction and intuition are much harder to teach and communicate to others, as Josh mentions. It explains why two investors might evaluate the same company but arrive at completely different conclusions.

If investment decisions were split evenly between explicit and implicit factors, the time spent on each wouldn’t be equal. I think explicit analysis/filtering (fundamental analysis and looking for red flags) takes much more time than implicit analysis/filtering (intuition of quality).

This leads to another thought related to cloning: In investment terms, "cloning" refers to the strategy of reviewing portfolios of successful investors or investment managers for ideas. Cloning is helpful because you can find managers whom (1) you trust are good analysts and (2) have some confidence that they put investments rigorously through their explicit filter.

Through cloning good investors we know that it is likely an investment will pass through our own explicit filter so we can focus more time on implicit analysis (intuition of quality).

Since explicit filtering takes longer than implicit, cloning is especially advantageous for a part-time investor because it saves time. However, even for a full-time investor the time savings increases the number of investable opportunities you are looking at and, since investing is really a game of opportunity cost, the more viable opportunities to compare against the better.

It is important to note that before making any investment it is still required to do a fulsome fundamental analysis yourself, cloning just lets you know which companies are likely to pass.

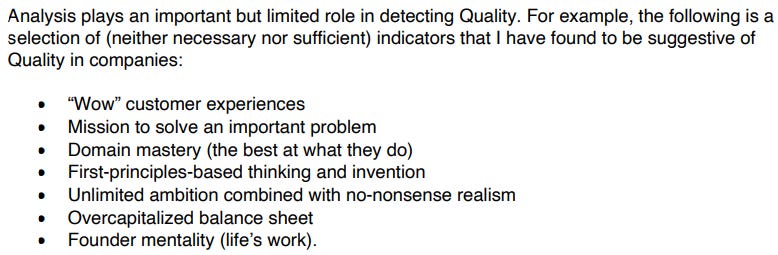

When Josh talks about implicit (intuition on quality) information he really focuses on the microeconomic aspects of companies. Look at the selection of indicators in his list and the chart at the bottom of this article, all but perhaps #2 are about what the company is doing internally and its culture.

I think implicit information also applies to macroeconomic aspects and the business model, as I listed above, both especially relevant for investments with longer time frames:

Consider these implicit questions we ask ourselves: What will this company look like in 10 years; Do I foresee a bigger total addressable market than other investors do (macro)?; Are there tailwinds (macro)?; Are there positively reinforcing attributes e.g. flywheels or network effects (business model)?; Is the product or service something customers will want more of in the future, or less of (for a dying industry), e.g. will people watch less cable TV in the future (business model)?

These are all intuitions we implicitly make when assessing where, and how big, the company will be in the future.

Excerpts from Josh’s post:

Here is a link to my full public portfolio in Google Sheets: Curious Investing Portfolio

The Conviction and quality article by Josh was a good read and I like your take on it. Things are interrelated. This is similar to Guy's quote - compounding knowledge. The more one learns, the more you recognize patterns - some of which are intuitive. It's a positive loop. Paulo Coelho puts it differently - he says, "all things are one".