Here is a link to my public portfolio in Google Sheets where I record my buy & sell activity: Curious Investing Portfolio

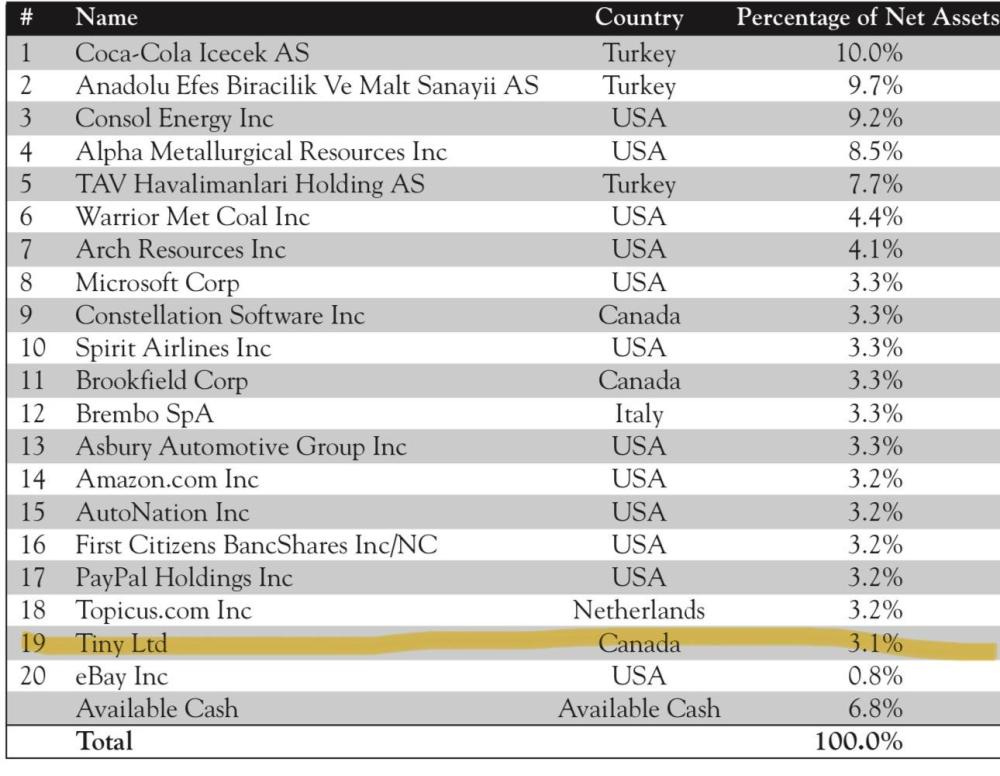

Mohnish Pabrai invested a small stake (3.1%) of his Pabrai Wagons mutual fund in Tiny. He must be following my blog and liked my small sizing (joking). If you remember in my first post on Tiny I included a quote from Mohnish Pabrai and he is where I originally sourced the investment idea.

Here is the link to the fund where this information and more can be retrieved: Pabrai Wagons Fund

Here are the holdings from his recently released semi-annual report:

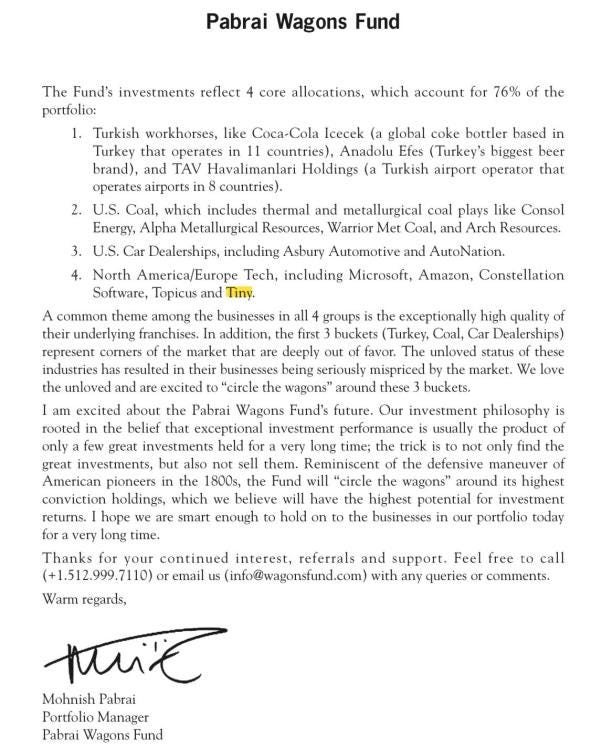

There’s very little additional discussion on Tiny in the report, and it’s a short read, so I’ve included the letter below:

For Tiny, I think as fundamentals start to line up with the story the market could change its view.

My current plan is to take a David Gardner approach with these types of companies (great story & destination, without an obvious margin of safety) -- start with a small allocation and see what happens; if they perform add up and if they don't, do nothing.

Note: I also cloned a couple of Mohnish’s metallurgical coal investments as they are aggressively buying back shares at a low earnings multiples (uber cannibals). Mohnish originally cloned the CEIX idea from David Einhorn.

All of my posts on Tiny can be found here: https://curiousinvesting.substack.com/t/tiny-capital-ltd

Disclaimer: As of March 24, 2024, I am a shareholder of Tiny Ltd. at an average cost base of $2.61, but it is currently a very small allocation (1.1%). My plan at the time of writing is to hold these shares long-term, but I may have sold my position by the time you’re reading this. This is not a purchase recommendation and I can only hope that I’m right on 3 out of 5 (60%) investments I make — this could be one I’m wrong on. Please do your own research and double-check my data & findings. Please also read my disclaimer and process here: Curious Investing Disclaimer and Process