Here is a link to my public portfolio in Google Sheets where I record my buy & sell activity: Curious Investing Portfolio

Introduction:

Tiny Capital Ltd. is a serial acquirer / capital allocator from Victoria, Canada.

Here is a brief summary of their business:

In 2016, Andrew Wilkinson and Chris Sparling started Tiny in the model of Berkshire Hathaway.

Using Mr. Buffett’s approach, Tiny has a small head office with two key functions: capital allocation and management selection / incentivization. They do not synergize costs or opportunities across their portfolio of companies.

Each business operates independently, with its own management and finance teams.

With ~$42M of total invested capital, they grew to $691M in equity value based on the merger value.

Upon completion of the merger with WeCommerce (announced Jan 23, 2023), Andrew (71% shareholder) and Chris (10% shareholder) will own approximately 81%, with the majority of their net worth in the stock.

Tiny Facts:

Buffet style (purchase businesses with good management and let the owner continue to run it with properly aligned incentives – see Tiny.com).

Tiny was a private company which focused investment in low capex & profitable, tech businesses; Andrew has mentioned he likes companies that create something once and sell it infinite times for marginal incremental cost i.e. Shopify themes or software (me too). To develop a program or theme that creates a lot of value might cost you $500K, but you can sell it to one customer, or a million customers, or a billion customers and your cost to create it doesn’t change.

Bootstrapped until recently (i.e. no debt taken on, they maintain near full ownership), and built the company to approx. $700M valuation based on a ~20x EV to 2021 AEBITDA multiple.

Bill Ackman said that he sees a lot of similarities between the way Andrew Wilkinson and Chris Sparling have run Tiny and the way legendary Wall Street value investors Warren Buffett and Charlie Munger have run Berkshire Hathaway, Inc. (Note: Bill Ackman invested in WeCommerce, and Andrew Wilkinson purchased an auction lunch with him, so he does have some bias).

Mohnish Pabrai:

I came across Tiny and Andrew Wilkinson through one of Mohnish Pabrai's videos.

Who is Mohnish Pabrai? He runs an investment fund with over $500M assets under management by himself and has no analysts, only administrative staff. He has a long track record of success and is friends with Warren Buffet & Charlie Munger. He is an excellent analyst and spends a lot of his time reading and thinking.

Below are a few quotes from Mohnish’s Q&A sessions:

Dec 5, 2022 video (click for link to YouTube; starts around 5:40):

Moderator: You're famous for checklists and I know that you don't necessarily talk about all the items on your checklist. If you're investing in another investment manager what would be on that checklist?

Pabrai: Yeah I think actually finding a good investment manager is a lot harder than finding a good investment. So it is a challenge and I think there's a few things you can look for to try to put the odds in your favor: so (1) is I think you would be looking for aligned fee structure where there's kind of a win-win on both sides you know. I took my fee structure from Warren Buffett where we don't have any management fees it's only performance fees; after the first six percent every year goes to investors there's a sharing after the six percent. So the first thing I'd look for is a fee structure that is aligned, which itself would be a stumbling block in this industry. (2) Is I'd like to find a manager with a lot of skin in the game so I would look for a large portion of their assets being co-invested alongside me that not only do they gain from the fees but they also have upside or downside based on their own assets so that's the second thing I would look for. (3) I'd look for a relatively young person, so basically I think we need enough years to be able to look back at their track record, but also enough years so that someone could have a 20-year run, or there about. So probably I would say about mid 40s type age band would actually be ideal, because if they've been in the industry from their early 20s then you've got about 20 odd years of information to look back on. So the third would be the age and then obviously the track record of what they've actually done that would give you some data points. (4) I would look for is where do they go, where do they go fishing, if you look at the US public equities markets they're very picked over you have a lot of funds we have more mutual funds than stocks in the US by some margin uh probably more ETFs than stocks and there's many stocks where they have 30 analysts following. So what I would look for is what's the kind of game plan to not be fishing where everyone else is. So these are some of the things, and then obviously (5) we're looking for people with high integrity and people that you align with and who in their past track record demonstrated that they can do meaningfully better than the market without taking as much risk.

Below is 8 months earlier, from April 4, 2022 (click for link to YouTube; starts around 47:45):

Moderator: On that topic, and you already gave away one, and this might be our last question for today but are there any new fund managers you found admirable and we recommend the students study and clone?

Pabrai: Yeah so I think there's always new managers emerging and one of the things about the investment business that's important to remember, Joel Greenblatt pointed this out, is when investment managers start out they have very little capital sometimes they just have their own capital, or their families capital, might even be just a million dollars or five million dollars very small amount. With one million, five million, ten million, you will be looking in nooks and crannies that a lot of other people don't because you could make a half million dollar investment or a hundred thousand dollar investment and it could move the needle. The great ones in that group when they start compounding, by definition, that five million is going to become 50 million and then 500 million and they will no longer be able to make a bet for a hundred thousand dollars, or five hundred thousand dollars, the bet size increases which means they have to leave the bottom, they have to leave the bottom which gave them all the success and so in investing, what happens is, the bottom continuously gets cleared out of great talent because the great talent moves up the food chain and the bottom gets available to the new emerging managers. So there are some managers: I think Josh Tarasoff is one name that comes to mind. I like Andrew Wilkinson a lot you know, he runs Tiny Capital out of Victoria in British Columbia, and he's at Tiny.com. So there's a bunch of these guys who are very well-versed in the emerging technologies and looking at different nooks and crannies… So I think that this is the great news about investing, the bottom is always available and then if you do well you move up with the rest.

Applying Pabrai’s checklist from above to Tiny Capital:

Aligned fee structure? It’s a public company and they own a significant stake so they gain and lose alongside the shareholders; assuming no exorbitant salaries.

Do they have skin in the game? The capital allocators own ~80% of the combined company.

Relatively young, but still has a track record? Andrew Wilkinson looks like he is in his 30s and his track record is acquiring companies to grow his portfolio to >$600M. It is plausible that he still has a long time remaining in the game.

Where do they go fishing? They are purchasing smaller companies outright, fishing in private microcaps mostly, the “nooks and crannies” – there is less focus in these areas and, as a result, greater mispricing. Tiny will also have access to additional private opportunities due to their reputation.

High integrity and people you align with. Hard to say at this point, but judging off his Twitter posts and interviews he seems to have a good mindset and follows the Buffett / Pabrai way of thinking. They are life-long learners.

Merger between WeCommerce and Tiny Capital:

I owned a small position in WeCommerce and sold for a ~50% gain after the merger announcement (luck on the merger catalyst) - my rationale to sell was that I thought they were assigning a high multiple to the shares on merging and I wanted to see the financials after the merger completed.

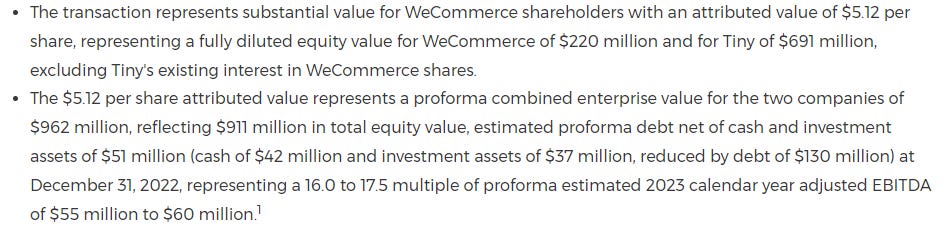

From the merger news release (https://www.newswire.ca/news-releases/wecommerce-signs-definitive-agreement-to-combine-with-tiny-882895846.html):

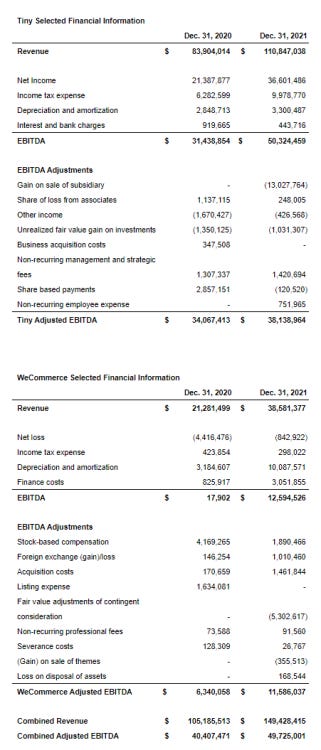

I’ve performed some quick math on amounts available at the time of the merger.

$962M Enterprise Value (EV) with:

$149.4M Revenue (2021);

$47.8M Adjusted EBITDA (w/ SBC adj. - 2021); or

$35.8M Earnings (2021)

Equates to 6.4 EV/Sales; 20.1 EV/Adj. EBITDA; or 27 EV/Earnings.

The AEBITDA and Earnings multiples above appeared expensive, but assuming their most significant subsidiaries are in the growth stage, Enterprise Value to Sales (EV/Sales) may be the best measure to value the company. EV/Sales is not a great valuation metric in general because the metric is also a factor of a company’s revenue growth per share, margins/profitability, and capital efficiency i.e. higher revenue growth, margins, and capital efficiency deserve a higher multiple.

The merger was a share transaction meaning the $5.12 wasn't being paid in cash and instead the price is based on an attribution of value. I thought the valuation seemed high based on the above valuation metrics, so when the shares approached the $5.12 attribution value I sold.

More recently…

Their recent EV / Sales is roughly 4.0 ($718M market cap + $82M net debt as of March 31, 2023 = $800M divided by $202M sales for the year-ended Dec 31, 2022).

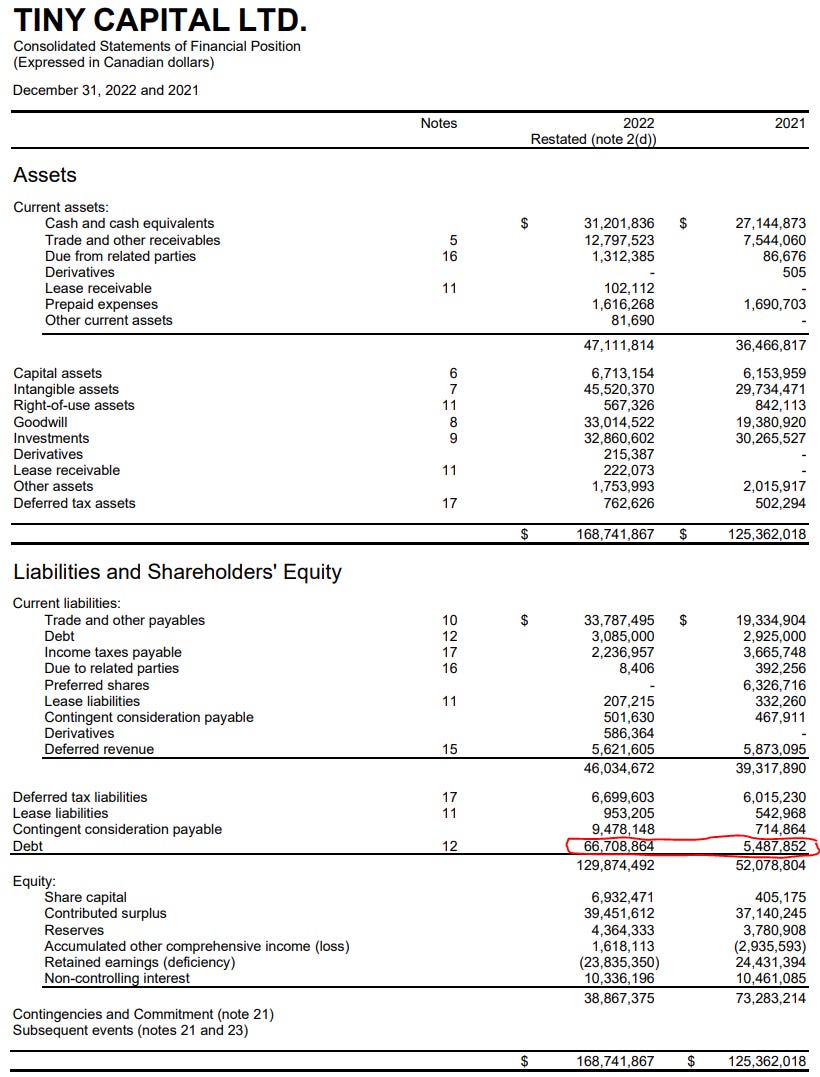

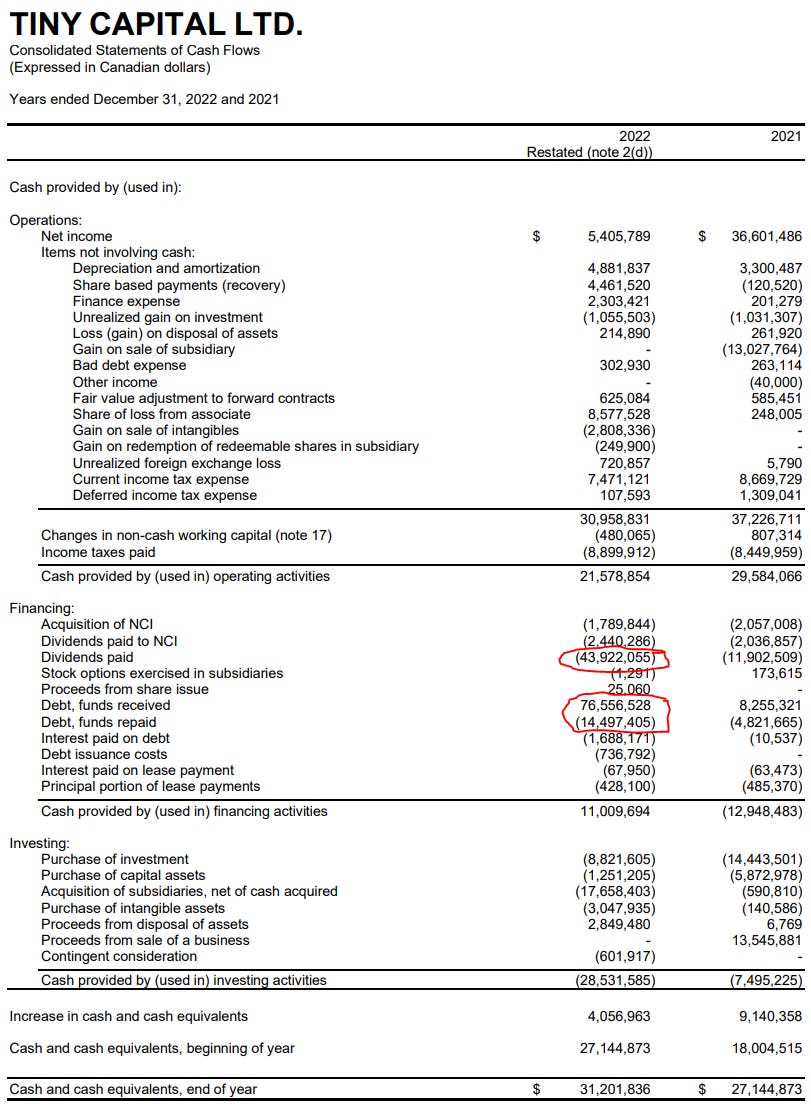

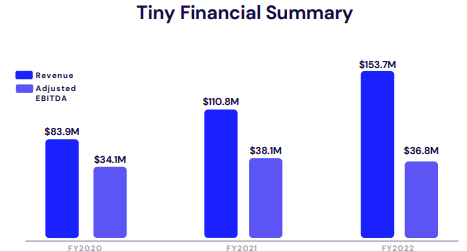

The financial statements for the year-ended December 31, 2022 show 22% consolidated revenue growth YoY vs 2021 (after normalizing for marketplace content cost reclassification), which is good. However, they added quite a bit of debt to the balance sheet as you can see below (below is Tiny’s financials only and excludes WeCommerce):

They borrowed ~$60M of debt and paid most of it to themselves in dividends before the merger - this will increase their interest expense going forward which we can already see on the income statement.

The rationale for the merger could have been to provide liquidity for their holdings and take some retained earnings out of the company. In addition, being a public company will give them another potential form of financing for acquisitions through shares.

FY23Q1 Earnings:

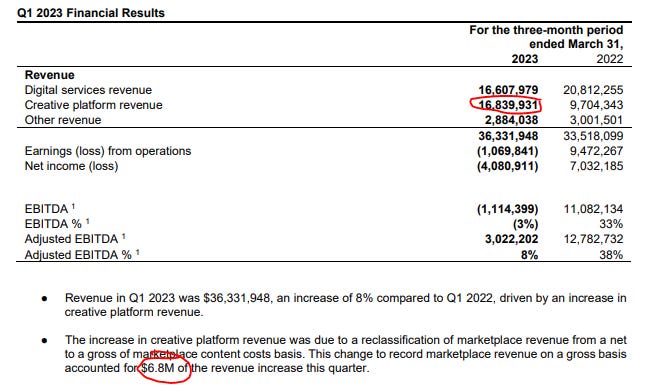

The most recent quarter’s results (FY23Q1) for Tiny are below and if you look closely revenue actually went down 12% YoY. 2023 Creative platform revenue has a +$6.8M revenue adjustment not included in the comparative period (see the second bullet point).

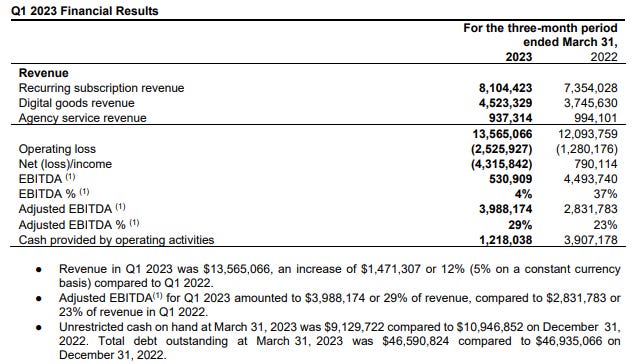

The most recent quarter’s results (FY23Q1) for WeCommerce are below, which was also in a net loss position for the quarter.

WeCommerce made acquisitions in 2021 when there was a lot of excess in the tech market, before the recent crash in VC valuations, so it's possible the purchases were made at unfavourable multiples. On the flip side, upcoming acquisitions at current prices will be more favourable now that valuations have come down.

Consolidated, the companies have $82M net debt i.e. debt minus cash ($37.5M in WeCommerce and $44.7M in Tiny).

Conclusion:

With all that said, I plan to buy back into Tiny eventually, but I think there are a lot of good deals in the micro cap market right now (opportunity cost) and I want to review the financials after a few consolidated quarters. If I am wrong on timing, I am ok to buy back in at higher prices because I think we are still early in Tiny’s story.

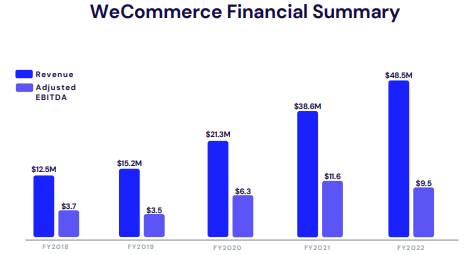

If they continue to grow for years to come like in the charts below, ideally including organic growth, we're splitting hairs on the entry price:

To me, Tiny Capital is a great story company with potential to be a long-term compounder. Andrew, Chris, and the team they’ve assembled appear to be exceptional managers and capital allocators with a long runway ahead of them, so I will continue to follow along.

See the following link for my second post on Tiny: https://curiousinvesting.substack.com/p/tiny-capital-ltd-recent-acquisitions

All of my posts on Tiny can be found here: https://curiousinvesting.substack.com/t/tiny-capital-ltd

Disclaimer: As of June 7, 2023, I have been following Tiny Capital Ltd. for over a year, but I own no shares. My plan at the time of writing is to hold these shares long-term, but I may have sold my position by the time you’re reading this. This is not a purchase recommendation and I can only hope that I’m right on 3 out of 5 (60%) investments I make — this could be one I’m wrong on. Please do your own research and double-check my data & findings.

Additional resources:

Interview with Andrew Wilkinson on the Investor’s Podcast:

I’ve linked an interesting Twitter thread from an insider below:

Aren't they still bleeding cash? It's hard to see the track record of buying profitable businesses beneath all the red ink. What am I missing here? Thank you so much.

Loved this concise analysis of Tiny.

The concept you have clearly elaborated here is that of cloning as encouraged by Mohnish. Andrew and Chris appear to be good capital allocators and I agree with you, Tiny looks like a good LT compounder. Great analysis and good read as always Curious Investor :)