Here is a link to my public portfolio in Google Sheets where I record my buy & sell activity: Curious Investing Portfolio

Tiny made a few more acquisitions recently, short excerpts are included below:

Tiny ("Tiny" or the "Company") (TSXV: TINY) a Canadian holding company and Dr. Andrew Huberman announce that their majority owned Canadian Yerba Mate Beverage – Mateina –is now available in the United States via drinkMateina.com. The U.S. launch includes a new sugar-free option that was co-developed with Dr. Huberman.

Tiny’s interest in Mateina is held through its private partnership, Tiny Fund I, LP. Dr. Huberman is a neuroscientist and professor in the department of neurobiology at Stanford School of Medicine, and also one of the top podcasters in the world with the Huberman Lab Podcast.

Tiny Announces Definitive Agreement to acquire WholesalePet

Founded in 2001, WSP has established itself as one of the largest pet wholesale marketplaces in the United States, growing gross merchandise value by more than 100% over the last 10-years. WSP specializes in serving pet boutiques, pet stores, and pet service businesses, including pet boarding and grooming. The platform enables thousands of independent pet retailers to purchase pet products from a diverse range of manufacturers and distributors. WSP operates solely as a marketplace, carrying no inventory.

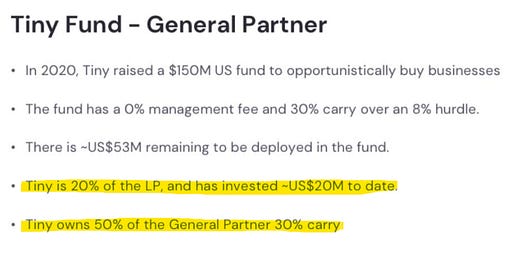

These are some very interesting acquisitions, but what I'm realizing is that some of the most exciting ones to me (unique & with the highest upside) are purchased through the Tiny Fund I i.e. Letterboxd and the Huberman Yerba Mate beverages. So based on the information below, it looks like Tiny shareholders only own a 20% stake plus a 15% (50% of 30%) performance fee over an 8% hurdle.

In a more recent presentation we see the term of the fund is 10 years with an option to extend 1 year. (tiny-shareholder-presentation-february-2024.pdf (q4cdn.com))

They left it more ambiguous to the reader by removing the % investment in the LP which was 20% in the above image, but I’m assuming they still own that stake.

Why did they raise a fund in this way with this structure? A couple theories: they have only been a public company for a short time and perhaps (1) when they started the GP fund they didn't originally plan to go public so soon; or (2) they had good opportunities and wanted to raise cash without diluting.

The fund does contribute to investor confusion, and holding companies typically trade at a discount to their parts, so adding confusion only hurts the investment case.

Financials

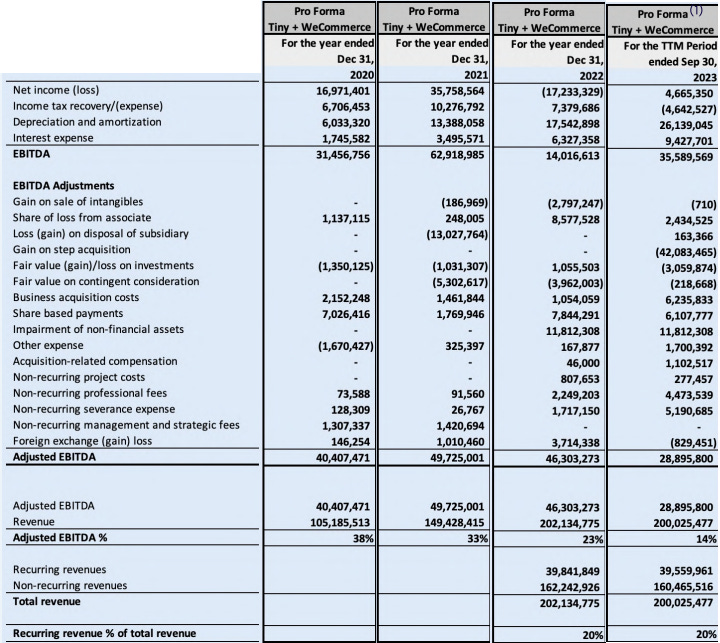

The presentation also included financials, which I rearranged for the last 4 years so it is easier to compare:

In the recent trailing-twelve-months ended Sept 30, 2023 revenue appears to be stalling and after excluding the $42M one-time gain adjustment, they incurred a significant loss. Overall, the revenue and earnings appear to be lumpy/unpredictable since going public, a couple speculative theories for this could be:

The agency operation makes up a large portion of their business and these revenues are project based - not guaranteed or recurring. This can lead to lumpiness in earnings / revenue.

They moved (acquired or sold) companies in / out of the Tiny umbrella throughout the years and before going public. I know Andrew owns some businesses privately as he speaks about them on podcasts.

Summary

I will be keeping my tiny (1.1%) investment in Tiny and wait for more post-public financial results before investing further. Going back to what I said before, if they really are the Berkshire Hathaway of the internet, this will be a long journey and you will have many opportunities to purchase along the way with extraordinary results.

The two drivers of the thesis for me are the types of businesses they are focusing on and management:

I think Andrew and Chris are great capital allocators, proven by their track record, and I have seen a few of Andrew's interviews and I believe he is a rational thinker;

As Andrew says, this is a management team "I would trust with my kids";

They are highly aligned to creating shareholder value as they own a substantial portion of the shares; and,

Just as important, they have a long runway as they are relatively young.

A good track-record, ethical (as far as I can tell), aligned, and with a long runway - these are the kind of leaders I want to invest in. I think there is a lot of potential here.

See the following link for my next post on Tiny: https://curiousinvesting.substack.com/p/tiny-and-the-pabrai-wagons-fund

All of my posts on Tiny can be found here: https://curiousinvesting.substack.com/t/tiny-capital-ltd

Disclaimer: As of March 24, 2024, I am a shareholder of Tiny Ltd. at an average cost base of $2.61, but it is currently a very small allocation (1.1%). My plan at the time of writing is to hold these shares long-term, but I may have sold my position by the time you’re reading this. This is not a purchase recommendation and I can only hope that I’m right on 3 out of 5 (60%) investments I make — this could be one I’m wrong on. Please do your own research and double-check my data & findings. Please also read my disclaimer and process here: Curious Investing Disclaimer and Process

Agreed Curious Investor, there's promise but a lot of unpredictable variables here. I think this does have a good upside over the LT